The Impact of Election Regulations on Market Dynamics

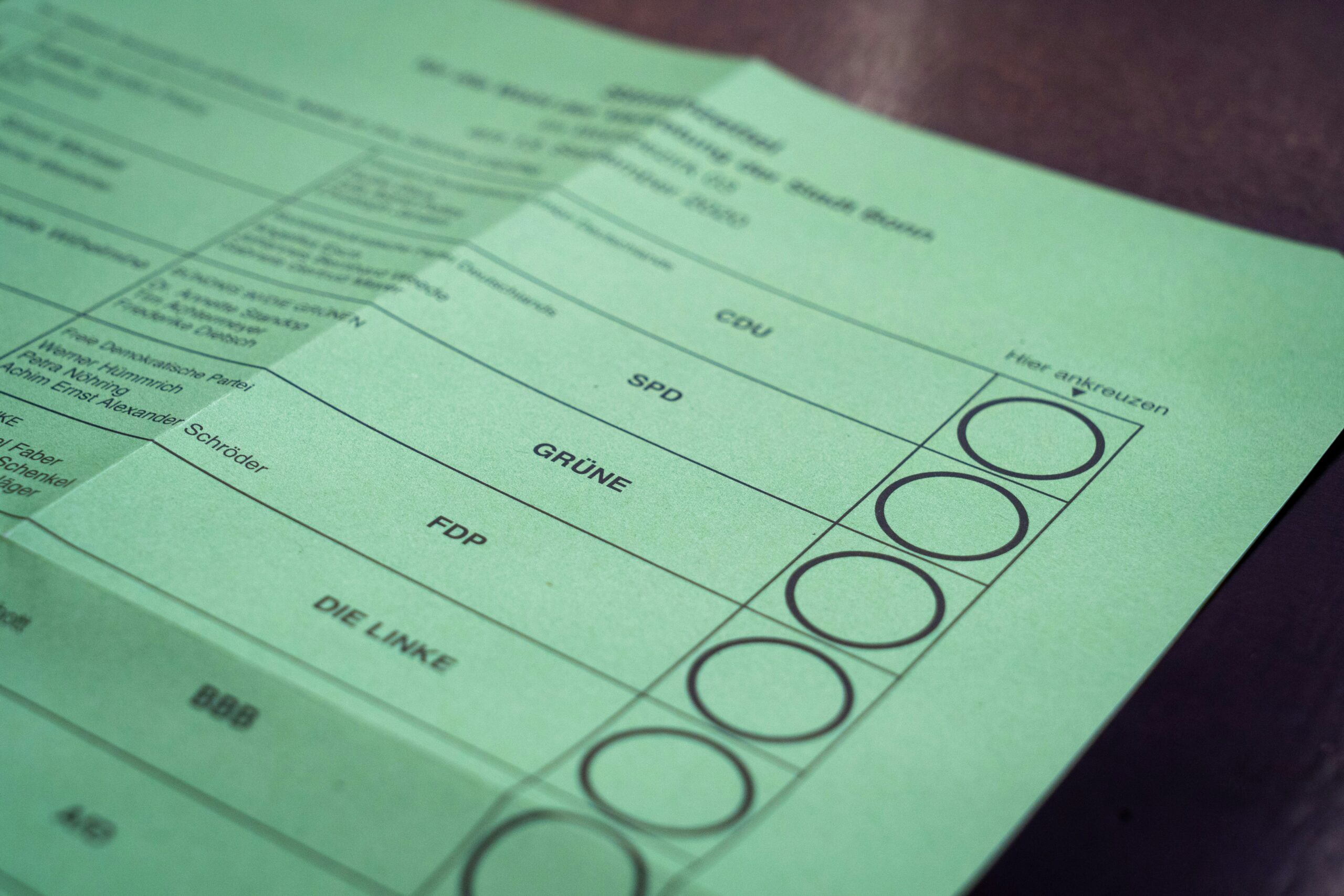

Regulations governing political contributions vary by country and are put in place to ensure transparency and accountability in the electoral process. These regulations often dictate the amount that individuals or organizations can contribute to a political campaign, as well as the reporting requirements for such contributions. By setting limits on how much can be donated, these regulations aim to prevent undue influence on political candidates and maintain the integrity of the democratic process.

Additionally, regulations governing political contributions often prohibit certain types of entities, such as foreign governments or corporations, from making contributions to political campaigns. These restrictions are put in place to safeguard against potential foreign interference in domestic elections and to uphold the sovereignty of the electoral process. By establishing clear guidelines on who can contribute and how much they can donate, these regulations aim to foster fair and competitive elections.

Regulations governing political contributions vary by country

Regulations ensure transparency and accountability in the electoral process

Limits are set on how much individuals or organizations can contribute to a campaign

Reporting requirements for contributions are also mandated

Aim is to prevent undue influence on political candidates and maintain democratic integrity

Certain entities like foreign governments or corporations may be prohibited from making contributions

Restrictions safeguard against potential foreign interference in domestic elections

Uphold sovereignty of the electoral process

Guidelines on who can contribute and how much they can donate foster fair and competitive elections

Impact of Campaign Finance Laws on Market Behavior

Campaign finance laws play a significant role in shaping market behavior by influencing the flow of money into political campaigns. These regulations aim to prevent corruption and ensure transparency in the political process. The limits set on campaign contributions and spending help maintain a level playing field among candidates and prevent any single entity from exerting undue influence over the electoral outcome.

Moreover, the enforcement of campaign finance laws can impact investor confidence in the market. When there is a perception of unchecked or unethical financial practices in political campaigns, it can create uncertainty and volatility in the market. Investors may react to uncertainties by adjusting their investment strategies, potentially leading to fluctuations in stock prices and market performance.

Influence of Election Spending Limits on Market Volatility

Political campaigns have a significant impact on the financial markets. The imposition of spending limits during elections can fuel market volatility as uncertainties surrounding policy changes and government regulations increase. Investors closely monitor campaign finance laws as they can influence the market behavior and shape investment decisions.

When election spending limits are imposed, it can lead to shifts in market sentiment and investor confidence. The markets tend to react to the perceived impact of campaign finance regulations on various sectors and industries. The restrictions on election spending can result in heightened market volatility as market participants navigate through the uncertainties associated with potential policy changes and their implications on the economy.

What are the regulations governing political contributions?

Political contributions are regulated by campaign finance laws, which set limits on how much money individuals and organizations can donate to political candidates and parties.

How do campaign finance laws impact market behavior?

Campaign finance laws can impact market behavior by influencing the flow of money into the political system. This can affect investor confidence and lead to market volatility.

What is the influence of election spending limits on market volatility?

Election spending limits can help reduce the influence of money in politics, which can lead to more stable market conditions. However, they can also restrict candidates’ ability to fund their campaigns effectively, which may have unintended consequences for market stability.